BofA To Offer Rentals As Foreclosure Alternative

Bank of America

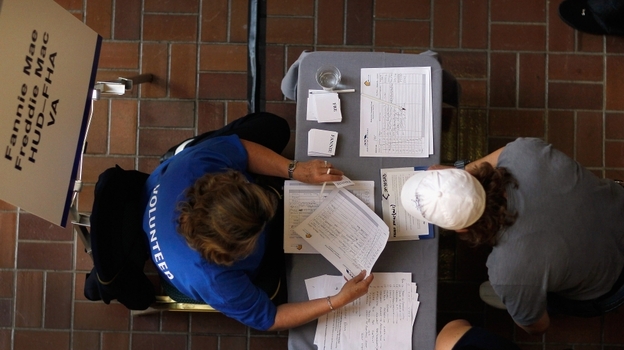

says it has begun a pilot program offering some of its mortgage

customers who are facing foreclosure a chance to stay in their homes by

becoming renters instead of owners.

The "Mortgage to Lease" program, which was launched this week, will be available to fewer than 1,000 BofA customers selected by the bank in test markets in Arizona, Nevada and New York.

Participants will transfer their home's title to the bank, which will then forgive the outstanding mortgage debt. In exchange, they will be able to lease their home for up to three years at or below the rental market rate. The rent will be less than the participants' current mortgage payments and customers will not have to pay property taxes or homeowners insurance, the bank said.

"This pilot will help determine whether conversion from homeownership to rental is something our customers, the community and investors will support," Ron Sturzenegger, legacy asset servicing executive of Bank of America, said in a statement.

Among requirements to qualify for the program, homeowners must have a BofA loan, be behind at least 60 days on payments and be "underwater," owing more on their mortgages than their homes are worth.

The bank based in Charlotte, N.C., said it will at first own the homes, then sell them to investors. If the program is successful, it could be expanded to include real-estate investors who buy qualifying properties and keep the occupants on as tenants.

"If this evolves from a pilot into a more broadly based program, we also see potential benefits from helping to stabilize housing prices in the surrounding community and curtail neighborhood blight by keeping a portion of distressed properties off the market," Sturzenegger said.

Foreclosure tracking firm RealtyTrac says foreclosure activity has picked up in some states, as banks deal with a backlog of homes with mortgages that had gone unpaid yet remained in limbo due to delays stemming from foreclosure-abuse claims, according to

Nevada has the nation's highest foreclosure rate as of last month, with one in every 278 households in the state receiving a foreclosure-related filing, twice the national average, according to RealtyTrac. Arizona ranks third behind California, while New York has not been as hard hit, with one in every 4,604 households receiving a foreclosure-related filing.

The "Mortgage to Lease" program, which was launched this week, will be available to fewer than 1,000 BofA customers selected by the bank in test markets in Arizona, Nevada and New York.

Participants will transfer their home's title to the bank, which will then forgive the outstanding mortgage debt. In exchange, they will be able to lease their home for up to three years at or below the rental market rate. The rent will be less than the participants' current mortgage payments and customers will not have to pay property taxes or homeowners insurance, the bank said.

"This pilot will help determine whether conversion from homeownership to rental is something our customers, the community and investors will support," Ron Sturzenegger, legacy asset servicing executive of Bank of America, said in a statement.

Among requirements to qualify for the program, homeowners must have a BofA loan, be behind at least 60 days on payments and be "underwater," owing more on their mortgages than their homes are worth.

The bank based in Charlotte, N.C., said it will at first own the homes, then sell them to investors. If the program is successful, it could be expanded to include real-estate investors who buy qualifying properties and keep the occupants on as tenants.

"If this evolves from a pilot into a more broadly based program, we also see potential benefits from helping to stabilize housing prices in the surrounding community and curtail neighborhood blight by keeping a portion of distressed properties off the market," Sturzenegger said.

Foreclosure tracking firm RealtyTrac says foreclosure activity has picked up in some states, as banks deal with a backlog of homes with mortgages that had gone unpaid yet remained in limbo due to delays stemming from foreclosure-abuse claims, according to

Nevada has the nation's highest foreclosure rate as of last month, with one in every 278 households in the state receiving a foreclosure-related filing, twice the national average, according to RealtyTrac. Arizona ranks third behind California, while New York has not been as hard hit, with one in every 4,604 households receiving a foreclosure-related filing.