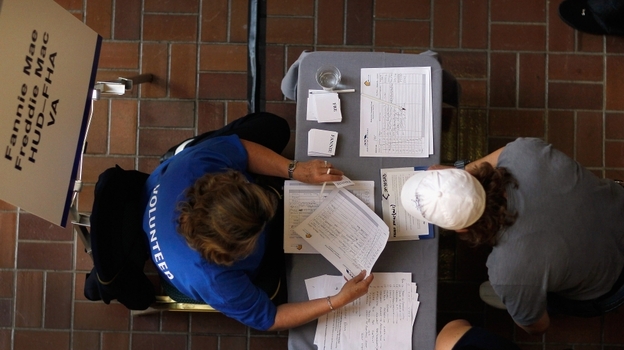

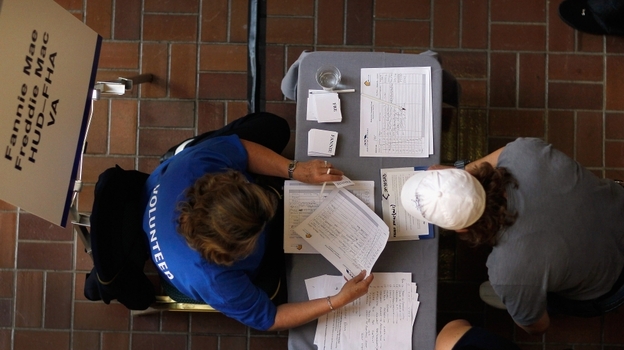

Joe Raedle/Getty Images A Fannie Mae/Freddie Mac mortgage services representative (left) helps a person register for mortgage help in Miami.

The two most powerful entities in the housing

market — Fannie Mae and Freddie Mac — could be on the verge of a

significant change regarding foreclosures. NPR and

ProPublica

have learned that both firms have concluded that giving homeowners a

big break on their mortgages would make good financial sense in many

cases.

In these so-called principal

write-downs, a portion of the loan is forgiven for someone who's having

trouble paying. Many Democrats are pushing for this change. Most

Republicans are against it. So far, a key federal regulator is blocking

Fannie and Freddie from adopting the approach.

In

recent days, financial executives at Fannie and Freddie have made

presentations to their regulator saying that principal reduction for

many homeowners would prevent larger losses and keep people in their

homes.

Read a

statement to NPR from Federal Housing Finance Agency Acting Director

Edward DeMarco about proposals to reduce mortgage principal:

"As

I have stated previously, FHFA is considering HAMP incentives for

principal reduction and we have been having discussions with the

Enterprises [Fannie Mae and Freddie Mac] and Treasury regarding our

analysis. FHFA's previously released analysis concluded that principal

forgiveness did not provide benefits that were greater than principal

forbearance as a loss mitigation tool. FHFA's assessment of the investor

incentives now being offered will follow the previous evaluation,

including consideration of the eligible universe, operational costs to

implement such changes, and potential borrower incentive effects. As we

complete the review, the public should understand that Fannie Mae and

Freddie Mac continue to offer a broad array of assistance to troubled

borrowers and have continued to implement HARP 2.0 to enhance

refinancing opportunities for underwater borrowers. FHFA remains

committed to its legal responsibilities as conservator to ensure

assistance is offered to troubled borrowers while minimizing losses to

taxpayers."

Watch a video of the FHFA's DeMarco testifying before the Senate Banking Committee on Feb. 28.

Read a blog post by Mark Calabria, director of financial regulation studies at the libertarian Cato Institute,

in support of the FHFA's DeMarco.

Read an online column by David Abromowitz, senior fellow at the liberal Center for American Progress, saying

principal reduction is overdue.

This is a big development in a charged political

issue. Some economists and many Democratic lawmakers see principal

reduction as a powerful tool for helping the housing market.

A Game Changer?

"Principal

reduction works," says Mark Zandi, chief economist of Moody's

Analytics. "If someone gets a reduction in their principal amount, it

gives them a powerful hook to really fight to try to hang on to the home

and not go into foreclosure."

As Zandi

explains, if someone is struggling to pay a $200,000 mortgage and their

house is only worth $150,000, the owner might decide to walk away. But

if the lender forgives $50,000 of the amount owed, that's a game

changer.

Fannie and Freddie guarantee and

control most of the home loans in the country. Zandi says that if Fannie

and Freddie "fully committed to the idea of doing more principal

reduction [modifications] that we would see several hundred thousand —

300,000 to 500,000 in principal reduction mods over the course of the

next several years of Fannie and Freddie loans. And that would make a

substantive difference."

That's 300,000 to

500,000 homeowners getting a big break on their mortgage. Zandi says

that could do a lot to tip the housing market toward recovery — and

thereby help the whole economy.

Other

economists disagree. And Fannie and Freddie's regulator has so far

refused to allow this approach. Ed DeMarco, the head of the Federal

Housing Finance Agency, controls Fannie and Freddie following a giant

federal bailout of the two companies. At a recent

Senate hearing, DeMarco said he wants to prevent foreclosures.

"But we need to do so in a way that we are meeting our mandate to protect the taxpayers," he said.

In other words, he needs to be a good steward of

taxpayer money. Last month, DeMarco testified that Fannie and Freddie

themselves told him that they didn't support principal reductions.

"Both

companies have been reviewing principal forgiveness alternatives. Both

have advised me that they do not believe it is in the best interest of

the companies to do so," he said.

Flood Of Defaults Feared

But

now Fannie and Freddie appear to be saying the opposite. In part that's

because the Obama administration has recently tripled the incentives it

offers to lenders who do these principal write-downs. So now, in many

cases, if a lender writes off, say, $50,000 of principal, the government

will reimburse half that — $25,000.

That's a lot of taxpayer money. Many Republican lawmakers don't like that. And some economists hope DeMarco stands his ground.

"I

think DeMarco is absolutely right," says Anthony Sanders, a professor

at George Mason University. He says that if Fannie and Freddie start

forgiving big chunks of what many people owe on their mortgage, they

risk triggering a huge wave of strategic defaults. That is, people who

don't really need the help would default on purpose to try to get it.

Once you throw

in principal reductions as a carrot, the level of disinformation from

consumers will be legion. People will then pretend they have to go into

default just to get the principal reduction.

- Anthony Sanders, a professor at George Mason University

"Once you throw in principal reductions as a

carrot, the level of disinformation from consumers will be legion,"

Sanders says. "People will then pretend they have to go into default

just to get the principal reduction."

Critics

say that could result in a near cataclysmic mess. Hundreds of thousands

of people could stop paying their mortgages. And they would flood their

lenders with calls, stumbling over each other to try to get free money.

"That's

going to take a lot of manpower to try to sort through these — who

actually needs one and who just wants a principal write-down at taxpayer

expense," Sanders says. "This could blossom into something really

ugly."

Still, the private sector has already

been doing many more principal write-downs — by one count, 15 percent of

all recent loan modifications. And proponents say so far the sky isn't

falling.

For his part, DeMarco told NPR in a

statement that the FHFA is now considering these new incentives and

whether they change his agency's prior analysis of principal reduction.

He added, "Fannie Mae and Freddie Mac continue to offer a broad array of

assistance to troubled borrowers."

Meanwhile,

political pressure on DeMarco is building, at least from Democrats.

More than 100 lawmakers have signed a letter asking him to reconsider

and allow principal reduction.

NPR's Chris Arnold reported this story in partnership with Jesse Eisinger of ProPublica.

UPDATE,

April 10, 2012: The National Fair Housing Alliance filed a complaint

with the U.S. Department of Housing and Urban Development against Wells

Fargo, alleging discrimination in foreclosure maintenance. The company

denied the charge.

UPDATE,

April 10, 2012: The National Fair Housing Alliance filed a complaint

with the U.S. Department of Housing and Urban Development against Wells

Fargo, alleging discrimination in foreclosure maintenance. The company

denied the charge.